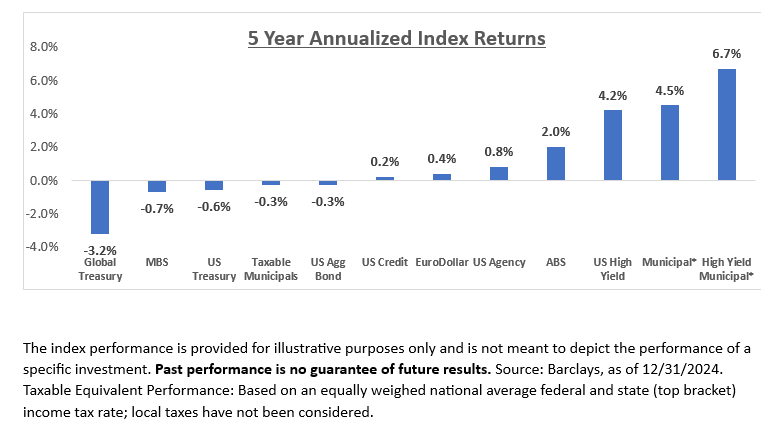

High-yield municipal bonds were the best-performing segment of the tax-exempt market in 2024. The Bloomberg High Yield Municipal Index returned a solid 6.32% for the year, outperforming by 527 basis points (bps) the Bloomberg Municipal Bond Index, which eked out 1.05%. High-yield municipals also outperformed most taxable fixed income market segments. The impressive performance of high-yield munis was a continuation of the asset class's strong performance over the longer term, rather than a departure from the norm.

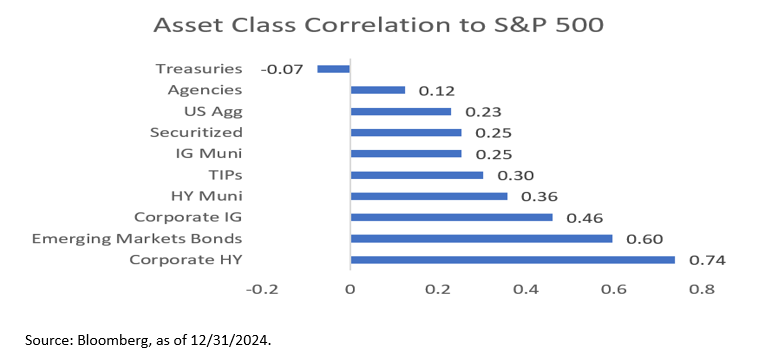

High-yield corporate bonds and high-yield munis have been two of the best-performing fixed income classes over the last five years. Despite the commonality in their name, historically, correlation between the two asset classes has been relatively low, at just .55.1 Moreover, high-yield munis have historically been less correlated to the stock market than high-yield corporates, at .36 and .74, respectively.2

High-yield munis' lower correlation to the S&P 500 could serve as a ballast for portfolios in times of equity volatility.

Drivers of strong 2024 performance

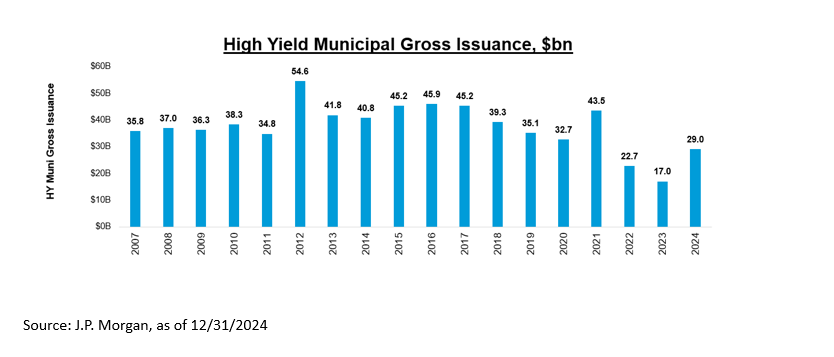

A positive technical environment contributed to much of the asset class's strong 2024 performance. Some $15.8 billion, or 38%, of the $42.1 billion total net inflows into municipal mutual funds and ETFs poured to high-yield municipal portfolios.3 Despite a significant year-over-year increase in overall municipal issuance, totaling $504 billion, the market was not flush with primary market high-yield municipal deals.

Quite the opposite, as just $29 billion (6%) of this supply has come from sub-investment-grade issuers. High-yield municipal issuance has averaged $42 billion since 2007, and 2024's supply figure is a significant decline compared to historical averages. Considering the strong demand for high-yield munis and lack of supply, there was not enough high-yield paper to go around. This supply-demand imbalance was a primary driver of the asset class's strong year and we believe it will continue to be a tailwind in 2025.

Positive 2025 outlook

While high-yield munis have outperformed the Bloomberg Municipal Bond Index over the past two years, we remain constructive on the space as we head into 2025 for the following reasons.

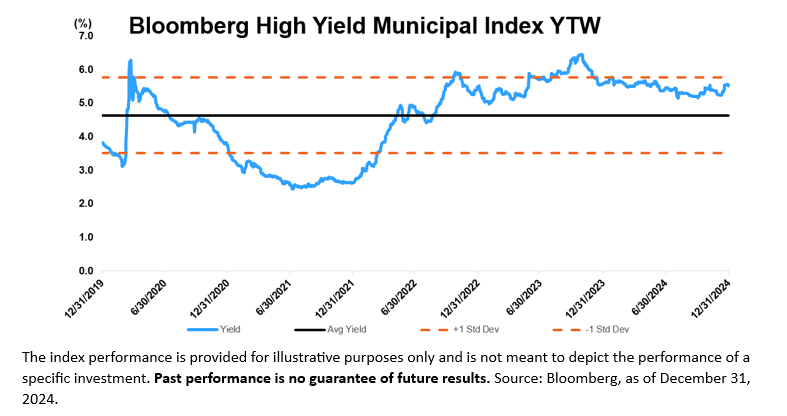

Attractive yields

Despite high-yield munis' outperformance in recent years, yields remain attractive. The Bloomberg High Yield Municipal Bond Index currently yields 5.52%, 89 bps above the index's average yield of the past five years. In addition, on a taxable-equivalent basis, the Bloomberg High Yield Municipal Bond Index currently yields over 9.32%, making it one of the highest-yielding sectors in fixed income.

Pockets of value remain

Over the last two years, high-yield muni credit spreads have tightened, and while they are currently narrower than their five-year average, they are 16 bps wider than their tightest five-year spread of 173 basis points. In comparison, investment-grade BBB municipal spreads, at 108 bps, are slightly above the Index's five-year average. If the economy remains resilient in 2025, municipal spreads could continue to tighten. However, an up-in-quality for the space could be rewarded in 2025 as BBB spreads are more attractive than high-yield spreads entering the year.

Muni credit remains strong

Strength in municipal credit creates a tailwind for high-yield muni performance, and currently municipal credit is in very good shape. From 2021 through 2023, S&P and Moody's credit upgrades exceeded downgrades by three times, or 300%. This trend continued in 2024, as the rating agencies upgraded twice as many credits as they downgraded.

Moreover, municipal defaults have remained well below the recent highwater mark of 89 unique defaults in 2020. There were only 57 unique defaults in 2023 and 62 unique defaults in 2024, a slight uptick but still well below 2020 levels.4

Bottom line: Elevated yields, strong credit fundamentals and positive technical factors are fueling an attractive outlook for high-yield municipal bonds in 2025. The sector merits consideration, in our view, as a core fixed income allocation for investors seeking strong income and potential performance upside.

1 Correlation measures the degree to which two securities or asset classes move in relation to each other. A correlation of +1.0 means they move in lockstep; a -1.0 means they move in different directions to each other and are uncorrelated.

2 Source: Bloomberg, as of 12/31/2024.

3 Source: J.P. Morgan, as of 12/31/2024.

4 Source: Municipal Market Data (MMD), as of 12/31/2024.

"High-yield munis lower correlation to the S&P 500 could serve as a ballast for portfolios in times of equity volatility."

Featured Insights

Risk considerations: There generally is limited public information about municipal issuers. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non-payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer's ability to make principal and interest payments. As interest rates rise, the value of certain income investments is likely to decline. Investments rated below investment grade (sometimes referred to as "junk") are typically subject to greater price volatility and illiquidity than higher-rated investments.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.