Existing global systems for economic growth rely on a linear "take-make-waste" approach to production, consumption and disposal. Consequently, as energy and materials are not recovered, resources are continually extracted and undue environmental harm in the form of pollution, biodiversity loss, and climate change is the norm. But a circular model can provide an alternative, as it decouples economic growth from finite resource extraction.1, 2 A circular economy system seeks to minimize waste, reuse existing products and recover materials.

In Calvert's view, companies that utilize this system can reap financially material benefits while also solving for their environmental goals. For example, feedstocks derived from recycled materials can increase supply chain resiliency, reduced production waste can lower costs, and new business models can connect consumers with previously used goods. In addition to these financial benefits, declines in materials extraction and waste can lead to significant environmental benefits through the mitigation of biodiversity loss and lowering of carbon emissions.

Gaining exposure to the circular economy

We believe investors can benefit from aligning themselves with a circular economy. Among the ways other stakeholders are involved include:

- Consumers are more aware of the environmental footprint of their choices, leading to changes in consumption and increased demand for innovative sustainable materials.3

- Corporations increasingly understand the need to expand offerings to meet consumer's environmentally conscious demand. In non-consumer facing sectors, as growth accelerates, meeting both demand and environmental objectives becomes increasingly challenging without significant changes to existing extraction/production models.

- Local legislating bodies, like California, are progressively introducing waste-aware regulations such as extended producer responsibility laws.4 These laws begin to price the externalities of waste by introducing penalties for non-compliance.

- National entities now recognize that securing stocks of the critical materials necessary for the energy transition is a prerequisite to energy security.5

- Internationally, nations are coming together to draft a legally binding agreement to address the plastic lifecycle with moderate progress made in 2024 and more work expected to continue in 2025.6

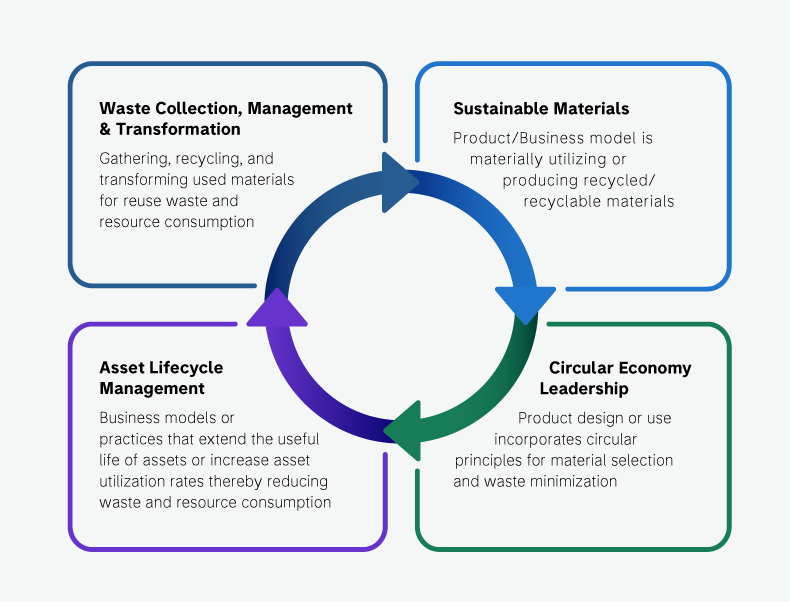

Against this backdrop, Calvert has identified four sub-themes that offer investors exposure to the circular economy. Our research analysts have developed nuanced frameworks that are unique to sector business models and aim to uncover issuers that have financially material exposure to circular economy themes. We describe each and offer an example below.

- Waste Collection, Management and Transformation - Gathering, recycling, and transforming used materials for reuse

Waste management companies are well positioned to recover the economic value of discarded metals, glass, paper, and plastic. Companies that operate landfills can also create new revenue sources by converting harmful methane emissions into renewable natural gas (RNG).

- Sustainable Materials - Product/Business model is materially utilizing or producing recycled/recyclable materials

Aluminum packaging producers are positioned to capture shifting consumer preferences. Aluminum is the most recycled form of beverage packaging at approximately 70% globally and contains a higher percentage of recycled content than alternative substrates (plastic and glass),7 which may make it attractive to environmentally-conscious consumers.

- Asset Lifecycle Management - Business models or practices that extend the useful life of assets or increase asset utilization rates thereby reducing waste and resource consumption

Rental and sharing business models allow a relatively small quantity of goods to be used more frequently in the service of a greater number of consumers. Increased asset utilization can reduce the absolute demand for raw materials, thereby reducing environmental impact.

- Leaders - Product design or use incorporates circular principles for materials selection and waste minimization

Consumer packaged goods companies can appeal to customers' environmental consciousness by utilizing bio-based, recycled, and/or sustainably sourced content in their products and packaging. By extension, these companies expand the marketplace for Sustainable Materials and can help strengthen the circular networks for materials moving through the economy.

Bottom line: As the world becomes increasingly resource-constrained, pollution-minded, and environmentally regulated, we believe the circular economy can present investors with the dual benefit of financially material business opportunities while solving for core environmental goals. Our identified sub-themes and nuanced company identification aim to provide investors with circular economy access points.

1 "Circular Economy," United Nations Economic Commission for Europe, April 18, 2024.

2 "What is a Circular Economy?," Ellen MacArthur Foundation. Accessible at https://www.ellenmacarthurfoundation.org/topics/circular-economy-introduction/overview.

3 "The Rise of Single-use Plastic Packaging Avoiders," Ellen MacArthur Foundation, July 12, 2022.

4 State of California, "Extended Producer Responsibility (EPR)," CalRecycle.

5 U.S. Office of Energy Efficiency & Renewable Energy, "U.S. Department of Energy Releases 2023 Critical Materials Assessment to Evaluate Supply Chain Security for Clean Energy Technologies," July 31, 2023.

6 United Nations, "Plastic pollution treaty negotiations adjourn in Busan, to resume next year," December 1, 2024.

7 "New IAI Study Reveals Environmental Benefits of Increased Global Aluminum Can Recycling," International Aluminum Institute, September 13, 2023.

Risk Considerations: There is no assurance a portfolio's investment objectives will be achieved. Investing involves risks. ESG Strategies that incorporate impact investing and/or Environmental, Social and Governance (ESG) factors could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. As a result, there is no assurance ESG strategies could result in more favorable investment performance.

See below for more important disclosures.

"We believe investors can benefit from aligning themselves with a circular economy."

Featured Insights

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.